March 30, 2021

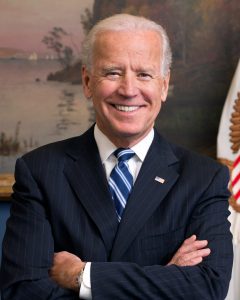

On March 12, not even three months after taking the oath of office, President Joe Biden signed into law the American Rescue Plan, a sweeping $1.4 trillion relief bill designed to save struggling families and lift the economy from the ravages of the coronavirus pandemic. And while the rollout of the plan is still in its infancy, child advocates, economists and pundits across the nation have heralded the plan’s provisions as “a policy revolution” and “a big freaking deal for families.”

Why? As with any large piece of legislation, the details can be complicated. But journalists and academics have been in overdrive for the last three months helping the American public understand what it could mean for families and have identified three key areas: cutting child poverty in half through the Child Care Tax Credit, saving child care, and protecting mothers by expanding Medicaid. Additional provisions include the expansion of the Supplemental Nutrition Assistance Program (SNAP) and SNAP for Women, Infants, and Children.

Biden’s administration introduced the “pillars” of the plan the day he took office, issuing a lengthy briefing document and giving journalists a running start on the legislation about to make its way through Congress. What ensued was a plethora of reporter and pundit commentaries, and journalists following the tricky political maneuvering in the Senate — now evenly split between Democrats and Republicans — to move the bill through. Senator Mitt Romney (R-Utah) even introduced a counter plan — The Family Security Act — showing a bipartisan acknowledgment that families needed help. Despite Republican opposition, however, the plan made it through, with many of the original pillars intact.

Biden’s administration introduced the “pillars” of the plan the day he took office, issuing a lengthy briefing document and giving journalists a running start on the legislation about to make its way through Congress. What ensued was a plethora of reporter and pundit commentaries, and journalists following the tricky political maneuvering in the Senate — now evenly split between Democrats and Republicans — to move the bill through. Senator Mitt Romney (R-Utah) even introduced a counter plan — The Family Security Act — showing a bipartisan acknowledgment that families needed help. Despite Republican opposition, however, the plan made it through, with many of the original pillars intact.

The biggest deal for families is the reform and expansion of the Child Care Tax Credit. Previously, the credit was $2,000 and only available to working families. The American Rescue Plan expanded that credit up to $3,600 per child, removed barriers to access, and made the provision available monthly rather than one lump sum. More than 10 million U.S. children lived below the poverty line in 2019 — a number that’s been worsened by the pandemic — and economists believe that giving families cash directly will have a profound effect on this. One journalist compared the plan to President Lyndon B. Johnson’s “Great Society” in its aim to lift families out of poverty. And while the IRS is having trouble delivering on the monthly payment aspect, families can still expect a boost.

Also included in the package is $39 billion to shore up the collapsed child care industry, an amount which was met with mostly praise from early care and education advocates. “We were really, really pleased to see the amount of funding in the plan,” said Rhian Allvin, CEO of the National Association for the Education of Young Children. Still, some acknowledged that while the plan would get the industry back to pre-pandemic levels, it would not give it the needed overhaul that Biden promised on the campaign trail. New information from the White House, however, suggests that follow-up legislation to the American Rescue Plan might address these concerns.

Another provision that has not received as much press gives states the option of extending Medicaid coverage for mothers for a full year after childbirth, which could significantly lower the country’s abysmal maternal mortality rates. Medicaid coverage currently ends 60 days following a birth, but the new piece of legislation allows states to opt-in to expand coverage for up to a full year with help from federal funding. More than 40 percent of births in the U.S. are covered by Medicaid, but a recent study found that 20 percent of new mothers skipped routine care because of cost after their coverage expired, putting them at risk.

To help our readers further understand the impact of The American Rescue Plan, we have compiled a library of article links, organized by focus areas, as well as opinion pieces. We hope you find these articles helpful in explaining the historic nature of the bill.

- Child Poverty and the Child Care Tax Credit

- Relief for the Child Care Sector

- Extending Medicaid and Saving Mothers’ Lives

- Mitt Romney’s Family Security Act

- Opinion Pieces: The American Rescue Plan and Child Poverty

- Opinion Pieces: Romney’s Plan and Comparisons with the American Rescue Plan

- Overall Passage

Child Poverty and the Child Care Tax Credit

CNBC: Biden claims his $1.9 trillion Covid relief plan will cut child poverty in half — here’s how

President Joe Biden said a $1.9 trillion Covid relief plan would cut child poverty in half. That would be the largest reduction in recent history, economists said. (Iacurci, 1/23/21)

MarketWatch: Here’s the maximum amount Biden’s stimulus proposal would deliver to America’s poorest families

‘Right now, the smartest thing we can do is go big,’ Janet Yellen said Tuesday. (Keshner, 1/23/21)

CNN: Democrats working on legislation to provide $3,000 payments per child amid pandemic

House Democrats are working on legislation proposed by President Joe Biden to expand the existing child tax credit, directing the IRS to send recurring monthly payments to American families, a source familiar with the matter confirmed to CNN. (Multiple Authors, 1/23/21)

Forbes: Everything You Need to Know About The Child Tax Credit in 2021

A breakdown of how the child tax credit works and how President Joe Biden hopes to expand the credit temporarily as part of his American Rescue Plan. (Washington, 1/25/21)

The New Yorker: A Bold Proposal to Ease Child Poverty Is the Essence of Bidenomics

To grasp the intellectual and political basis of Bidenomics, a good place to start is his proposal to provide additional financial support to the more than one in seven American children who are currently living in poverty. (Cassidy, 1/26/21)

Fatherly: Democrats Want to Dramatically Expand—and Transform—the Child Tax Credit

Here’s how their current proposal could cut child poverty in half. (LeBlanc, 1/25/21)

The Huffington Post: Republicans Cool To Expanding Child Tax Credit As Part Of COVID-19 Relief

If Democrats want to slash child poverty, they may have to do it themselves. (Delaney & Bobic, 1/27/21)

POLITICO: Democrats’ plan to fight child poverty: Monthly cash for kids

It’s designed to substantially reduce the number of children living in poverty by getting money into their parents’ pockets quickly and steadily. (Faler, 1/27/21)

Desert News: Would child tax credit help more if paid monthly? Disagreement rages

Policymakers don’t want children to be poor. But how to help is a complicated question (Collins, 1/31/21)

The Sacramento Bee: California parents would get big tax breaks under Biden’s COVID economic relief plan

Expanding the Child Tax Credit could help the parents of an estimated 10.1 million children in California. The poorest 20% of state income earners – who make less than $26,500 a year – could get an average $4,250 tax break, according to the Institute on Taxation and Economic Policy, a Washington-based economic research group. (Lightman, 2/2/21)

Forbes: How Biden Could Expand And Better Target The Child Tax Credit

In a recent blog, there were two ways discussing how Congress could refocus those $1,400 per person relief payments on those who need it most. But there is an even stronger case for better targeting President Biden’s proposed increases in the Child Tax Credit (CTC). (Gleckman, 2/2/21)

NPR, Morning Edition: Biden Plan To Expand Child Tax Credit Could Help Millions Out Of Poverty

NPR’s Steve Inskeep speaks with Chuck Marr, director of federal tax policy at the Center for Budget and Policy Priorities, about the Biden administration’s proposal to expand the child tax credit. (2/4/21)

Politico: Dems Try To Shoehorn Major Child Poverty Reduction Plan Into Covid Bill

Congressional Democrats will try to insert a major child poverty reduction proposal into their Covid relief package when it comes up for consideration in the next few weeks. (Stein, 2/7/21)

Slate: Democrats Want to Add $3,000 Cash Payments for Families With Children to COVID Relief

House Democratic leaders are getting ready to put forward a proposal that would see millions of families with children get additional direct cash payments as part of President Joe Biden’s $1.9 trillion COVID-19 relief package. (Politi, 2/7/21)

Also featured in Forbes (Brewster, 2/7/21), The Washington Post (Stein, 2/7/21), The New York Times (Cochrane & Rappeport, 2/7/21), CNN (Politi, 2/7/21), The New York Magazine (Politi, 2/7/21), Axios (Goba, 2/7/21)

The New York Times: Congress Pursues Child Tax Credit And Other Relief To Help Families

The early weeks of the Biden administration have brought a surge of support, in the White House and across party lines in Congress, for what could be the most ambitious effort in a generation to reduce child poverty. (Tankersley and Cochrane, 2/8/21)

Politico: Democrats’ Plan To Lift Work Requirement Could Complicate Child Poverty Plan

Democrats’ bid to expand a popular tax break for children is stirring up ghosts of Clinton-era battles over welfare, which threatens to take the bipartisan sheen off their effort. Buried in their proposal is a plan to scrap decades-old rules pegging whether someone can take the credit, as well as how much they can receive, to how much they earn. (Faler, 2/8/21)

MarketPlace: Dems’ family agenda: tax credits, child care and school aid, paid leave

House Democrats are reportedly about to introduce a plan to boost child tax credits for American families — up to $3,600 per kid, paid in monthly installments and phasing out for higher-income parents. (Hartman, 2/8/21)

Wall Street Journal: Child Tax Credit Poised for Expansion in Stimulus Bill

Democrats are poised to pass a significant—but temporary—expansion of the child tax credit as part of President Biden’s coronavirus relief package. Here’s a guide to the credit and the proposals to expand it. (Rubin, 2/8/21)

Also seen in CNET (Gonzalez & Rayome, 2/8/21), USA Today (Picchi, 2/9/21)

Bloomberg: U.S. Child-Poverty Crisis Spurs Stepped-Up Efforts In Congress

Support is rising among policy makers to address America’s child-poverty crisis, which is getting worse as the pandemic drags on. More than 8 million Americans — including many children — fell into poverty during the second half of last year, exacerbating the racial and income inequalities that are holding back the U.S. economy. (Saraiva and Davison, 2/9/21)

CNBC: Democrats push forward with temporary $3,000 child tax credit, but some want to make increase permanent

The $3,000 increase would be temporary, some lawmakers want to see a permanent boost put in place to dramatically reduce child poverty in the U.S. (Leonhardt, 2/9/21)

Forbes: Everything You Need To Know About The Child Tax Credit $300 Monthly Payments

In the past month, there have been three major proposals to address the growing issue of child poverty. (Rowan, 2/9/21)

The Washington Post: Democrats want to give parents $250 a month. Here’s who qualifies.

Here are more details on who would qualify and how it would work. The plan must still be approved by the House of Representatives and Senate before it can be signed into law. (Long & Stein, 2/10/21)

USA Today: Two decades in the making, Rosa DeLauro’s plan to cut child poverty in half is on the brink of passing

She knew the president’s top advisers were drafting a sweeping plan to deliver the nation from historic economic depths, and there was no way, not after an 18-year-long battle to lift millions of children from poverty, that Rosa DeLauro was going to stay out of that. (Carrazana, 2/11/21)

The Wall Street Journal: Universal Basic Income Could Be Coming for Kids

Tax-credit proposals would send almost every parent $250 or more a month. (Ip, 2/17/21)

POLITICO: How kids ate the tax code

The Child Tax Credit is poised to become the biggest federal tax break, thanks to bipartisan support. (Faler, 2/24/21)

MarketPlace: Relief bill could lift millions of kids out of poverty by expanding tax credit

We’ve been looking into different parts of the big COVID-19 relief package working its way through the House of Representatives, possibly coming up for a vote later this week, and some of the ways it aims to use changes to tax law to provide economic relief in the pandemic. (Adams, 2/24/21)

NPR: With One Move, Congress Could Lift Millions Of Children Out Of Poverty

President Biden and Democratic lawmakers want to fight child poverty by giving U.S. families a few hundred dollars every month for every child in their household — no strings attached. (Turner & Kamenetz, 2/26/21)

The Hill: Democrats adjust language on child tax credit in relief bill

House Democrats are slightly modifying language in a provision on the child tax credit in their coronavirus relief package in an effort to prevent the Senate parliamentarian from ruling against the provision. (Jagoda, 2/26/21)

CNET: New child tax credit may bring more money than the stimulus check. What to know

Here’s how the COVID-19 relief bill could provide more money to families with children. (Gonzalez & Raymone, 2/27/21)

Newsweek: Stimulus Package Could Mean $14,000 Windfall for Family of Four

The stimulus bill is aimed at helping Americans left reeling by the coronavirus pandemic, but one analysis has said the direct payments to individuals of $1,400 are less important than the windfall that some families might get. (Cole, 2/27/21)

CNBC: House raises child tax credit to $3,000, but only for a year

The House of Representatives passed the $1.9 trillion Covid-19 relief package on Saturday, which included a temporary increase for the child tax credit. (Leonhardt, 3/2/21)

The Wall Street Journal: Democrats Seek Temporary Expansion of Child Tax Credit, but Making It Permanent Is Real Goal

Supporters are already warning of consequences of allowing it to expire at the end of 2021—as scheduled in their bill. (Rubin, 3/3/21)

CNET: Parents of 2020 babies could get an extra $1,100 stimulus check. Here’s how

It’s time to claim missing stimulus check money for babies born in 2020. Here’s exactly how to do it. (Langlo, 3/3/21)

USA Today: Biden’s COVID-19 relief plan includes a child tax credit boost popular with Democrats but a ‘nightmare’ to Republicans

Democrats’ $1.9 trillion COVID-19 relief bill includes a proposed change to the tax code aimed at pulling millions of children out of poverty, but it’s likely to see Republican objections as the Senate considers President Joe Biden’s plan this week. (Wu, 3/3/21)

The New York Times: In the Stimulus Bill, a Policy Revolution in Aid for Children

The $1.9 trillion pandemic relief package moving through Congress advances an idea that Democrats have been nurturing for decades: establishing a guaranteed income for families with children. (DeParle, 3/7/21)

Also seen in CNET (Gonzalez & Rayome, 3/7/21), The Chicago Tribune (Kaplan, 3/7/21)

Reuters: U.S. could send $1,400 COVID bill payments within days; child tax credit a bigger challenge

The bill also includes an expanded Child Tax Credit of up to $3,000 per child, paid monthly starting in July, essentially forcing the revenue collector to act as benefits administrator for the rest of the year. (Lawder, 3/8/21)

Also seen in U.S. News & World Report (3/8/21)

The Morning Call: Stimulus bill contains a policy many Democrats have wanted for years: Guaranteed income for families with children

Obscured by other parts of President Joe Biden’s $1.9 trillion stimulus package, which won Senate approval Saturday, the child benefit has the makings of a policy revolution.(Deparle, 3/8/21)

NPR: What The $300 A Month Child Benefit Could Mean For A Family On The Edge

This benefit, combined with other enhanced benefits in the package, could cut child poverty in the U.S. by half, according to an analysis by Columbia University. (Kamenetz, 3/9/21)

MarketPlace, Make Me Smart Podcast: Is this finally the moment Americans get universal child care?

Women’s workforce participation is at a 30-year low, in part because so many are busy caring for children at home during the COVID-19 pandemic and taking on a disproportionate amount of other domestic work. (Ryssdal and Wood, 3/9/21)

MarketPlace: Will an expanded child tax credit solve the “she-cession”?

More than 2 million women have left the workforce since the start of 2020, and many did so to care for children. Plus, why Unilever will stop using the word “normal” on its products. (Ho, 3/9/21)

The Washington Post: Third round of coronavirus relief offers significant cash to parents

What you need to know about payments for children and dependents in the American Rescue Plan. (Singletary, 3/9/21)

Also seen in ABC News (Stoddart, 3/10/21)

PBS: Child tax credit expansion sets up showdown with GOP

It sets up a potential political showdown with Republicans over an issue that Democrats believe could drive significant wins for the party in the 2022 midterm elections and beyond. (3/9/21)

CalMatters: ‘Revolutionary’ federal stimulus bill could cut California child poverty by half

The $1.9 trillion federal stimulus package includes a temporary expansion of the child tax credit. Some California experts are likening it to a universal basic income and say it’s urgently needed, especially for California’s families with undocumented parents left out of previous stimulus relief. (Botts, 3/10/21)

Vox: Joe Biden just launched the second war on poverty

The first war on poverty cut it in half. Joe Biden could do it again. (Matthews, 3/10/21)

Working Mother: What the $1.9 Trillion Stimulus Package Means for Working Moms

President Joe Biden signed into law the American Rescue Plan, a $1.9 trillion package for coronavirus relief, on Thursday, March 11.. (Kingo and Fish, 3/11/21)

CNBC: 4 big changes are coming to the child tax credit

Families with kids — especially low earners — are poised to get a bigger break on their taxes next year. The $1.9 trillion American Rescue Plan, which President Joe Biden hopes to sign Friday, makes some big changes to the child tax credit. (Iacurci, 3/11/21)

Wall Street Journal: Child Tax Credit: How the Covid-19 Stimulus Package Gives Additional Money to Families

The new law signed by President Biden on Thursday increases the credit to $3,000 a child and makes parents of 17-year-olds newly eligible. (Zitner, 3/11/21)

CNBC: New $3,000 child tax credit could raise issues for divorced parents

Divorced parents have to navigate a lot of challenges, but there’s a new issue looming on the horizon thanks to the $1.9 trillion American Rescue Plan: the child tax credit. (Leonhardt, 3/11/21)

USA Today: From child care to school reopenings, $1.9T COVID relief package gives a financial lift to America’s struggling families

While the sweeping $1.9 trillion American Rescue Plan offers something for almost everyone affected by the COVID-19 pandemic… America’s families stand out as the biggest winners and are poised to benefit in myriad ways. (Davidson, 3/12/21)

The New York Times: A Break for Working Families

The government is allowing people who qualify for the earned-income tax credit to use income from either 2020 or 2019, whichever will result in a bigger credit. (Carrns, 3/12/21)

Politico: Booker says he’s trying to permanently expand enhanced child tax credit

Sen. Cory Booker (D-N.J.) said Friday that he is working to permanently expand tax credits that were temporarily boosted as apart of President Joe Biden’s $1.9 trillion coronavirus relief package, a move he said could help middle class families across the country. (Han, 3/12/21)

The Hill: Biden aims to make $300 monthly child tax credits post-pandemic

Democrats angle to make increases in the Child Tax Credit permanent. (Kelley, 3/15/21)

Romper: How 42 Families Plan To Spend The Child Tax Credit

With President Biden’s recently passed American Rescue Plan, an aspect of this legislation may have an even more powerful impact on families: expansion of the child tax credit. But what does the child tax credit mean? (Kenney, 3/15/21)

Forbes: Biden Wants $300 Checks Every Month For Children

President Joe Biden wants to send you $300 checks every month if you have children. Here’s what you need to know. (Friedman, 3/15/21)

The Washington Post: Child Tax Credit May Be Delayed In New Stimulus

A program authorized under the $1.9 trillion stimulus to combat child poverty is at risk of early delays, as the Internal Revenue Service grapples with its massive tax backlog and recent decision to extend the tax-filing deadline until May 17. (Romm, 3/18/21)

Also seen in CNN (Luhby, 3/19/21)

CNBC: New $3,000 child tax credit might not come with monthly payments, IRS says

The child tax credit payments authorized in the latest Covid relief bill may not be sent monthly and may not even start in July, IRS Commissioner Charles Rettig said. (Reinicke, 3/19/21)

CNET: Stimulus money and tax breaks: All the extra cash parents and the elderly could get

Tax breaks and credits could mean way more cash beyond the $1,400 payment for your family this year. (Rayome & Brown, 3/20/21)

CNET: $3,600 Child Tax Credit for 2021 FAQ: 5 things you should know

Here are all the details of the new CTC, which the IRS says it’s still working to implement. (Gonzalez & Rayome, 3/20/21)

CNET: Child Tax Credit for $3,600: When will your payments come and how often?

If you qualify for the 2021 Child Tax Credit, you could start receiving payments in just months. Here’s what you need to know. (Conner, 3/22/21)

The New York Times: How 2 Legislative Tacticians Scored Big Wins on Child Poverty in the Stimulus

After working for decades on the issue, Senator Patty Murray and Representative Rosa DeLauro teamed up to ensure that the stimulus law included a lifeline to the nation’s poorest families. (Cochrane & Edmondson, 3/28/21)

Relief for the Child Care Sector

KCRW: What are Biden’s child care plans? Pandemic has left millions of working mothers jobless

President-elect Joe Biden wants to spend nearly $800 billion overhauling the American child care system, funding universal preschool and paid family leave, boosting salaries for child care workers, and building new day care centers. (Brand, 1/19/21)

Vox: Biden’s Covid-19 stimulus plan includes $40 billion for child care

America is in a child care crisis. This is Biden’s first step to address it. (North, 1/20/21)

The Appeal: Biden’s Sweeping Caregiving Plan Has Overwhelming, Bipartisan Support

Polling from Data for Progress and the Lab, a policy vertical of The Appeal, shows broad bipartisan support for key elements of Biden’s proposal. (McElwee & Milam, 1/22/21)

WNYC, The Takeaway: Is the Biden Administration Ready to Tackle the National Child Care Crisis?

The Takeaway spoke to Lea Austin, director of the Center for the Study of Child Care Employment at UC Berkeley. (1/27/21)

First Five Years Fund: Senate Republicans Include $20 Billion for Child Care in Latest COVID-19 Relief Proposal

A group of 10 Republican senators have released the details of an economic relief package that includes $20 billion in funding for the child care industry, underscoring the sentiments on Capitol Hill about the essential role of child care for children, families, and the economy. (Uhing, 2/2/21)

First Five Years Fund: U.S. Chamber of Commerce Urges President, Congress to Provide Child Care Relief Funding

In a new letter to President Biden and members of Congress detailing priorities for upcoming pandemic relief legislation, the U.S. Chamber of Commerce is calling for financial relief for the child care industry amid the ongoing COVID-19 economic crisis. (Joughin, 2/2/21)

EdSource: How the Biden administration will impact California’s child care crisis

Change can’t come fast enough for families and child care workers, experts say. (D’Souza, 2/4/21)

Brookings Institute: Stabilizing child care requires more than emergency COVID-19 relief funds

Emergency stabilization funds to mitigate the pandemic’s immediate damage are an important first step. But returning to a pre-coronavirus baseline would not be enough to create a stable child-care sector that adequately supports kids and families. (Bassok, Markowitz and Bellows, 2/16/21)

HuffPost: The COVID-19 Relief Bill Could Be A Huge Turning Point For Child Care In The U.S.

There’s a desperately needed $39 billion bailout for child care providers in the bill, a sign that lawmakers finally understand the importance of caregiving. (Peck, 3/3/21)

POLITICO: A $39 billion lifeline for American child care

It might seem like the nation’s child care providers are flush with cash right about now, if you’re only looking at government spending. (Perez, 3/8/21)

First Five Years Fund: Child Care and Early Learning in the American Rescue Plan Passed By the Senate

On Saturday morning, the Senate voted to pass the American Rescue Plan, a sweeping pandemic relief package with $39 billion in child care relief funding. (Joughin, 3/6/21)

MarketPlace: $40 billion for child care

We break down where funding in the COVID relief package is directed, including aid for child care and money for restaurants. (3/10/21)

CNBC: Congress greenlights a $40 billion bailout for the child-care industry

With the passage of the American Rescue Plan Act on Wednesday, American families and child-care providers can look forward to a roughly $40 billion infusion for an industry rocked with closures and dramatically increased operating costs amid the pandemic. (Leonhardt, 3/10/21)

Quartz: Biden’s rescue plan says child care is too important to leave to the market

One of the major elements of the American Rescue Plan is the conversion of the child care tax credit into a child care allowance, to be paid in $300 monthly installments to single parents earning less than $112,000 annually, and two-parent households earning less than $150,000. (Fernholz, 3/10/21)

EdSource: What the federal stimulus bill means to California’s child care sector

President Joe Biden’s child care relief bill, part of the sweeping $1.9 trillion American Rescue Plan that the president signed into law Thursday, may not end the growing child care crisis, but it will throw a much-needed lifeline to a field on the brink of collapse, early childhood advocates say. (D’Souza, 3/11/21)

Morning Consult: If Not Now, When? It’s Time to Transform Child Care

President Joe Biden has signed the American Rescue Plan into law, granting $40 billion in child care funding and providing much-needed relief to providers, parents and children alike. (Cardona, 3/22/21)

Extending Medicaid and Saving Mother’s Lives

The Washington Post: COVID-19 bill gives states pathway to reduce maternal deaths

Labor and delivery are thought of as the riskiest times for new mothers, but many women die in the weeks and months after giving birth. Now a provision in the COVID-19 relief bill could help change that. (Alonso-Zaldivar, 3/11/21)

Scientific American: We Must Extend Postpartum Medicaid Coverage

And that must go hand in hand with better access to quality care, redress of systemic barriers to vital health, and social services and supports. (Taylor, Aisodu, Mehra, Alspaugh, Bond, Franck, & McLemore, 3/11/21)

The Hill: Congress must permanently extend postpartum Medicaid coverage

Today, many of our most vulnerable moms spend most of the first year after childbirth — when they are still at risk of complications and even death — with no or unstable health care coverage. (Stewart, 3/12/21)

The New York Times: Small Piece of the Stimulus Has Ambitious Aim of Saving Mothers’ Lives

The expansion of Medicaid is an effort to address the highest maternal death rate among wealthy nations. (Kliff, 3/14/21)

Kaiser Family Foundation: Postpartum Coverage Extension in the American Rescue Plan Act of 2021

Inside the $1.9 trillion American Rescue Plan Act of 2021 is a less noticed provision that makes a major change to Medicaid coverage for low-income pregnant and postpartum women, addressing a long-standing gap for people who have had their maternity care covered by Medicaid, especially those in states that have not expanded Medicaid as permitted by the ACA. (Multiple Authors, 3/18/21)

Mitt Romney’s Family Security Act

The Huffington Post: Mitt Romney Proposes $350 Monthly Child Allowance

The Utah Republican’s proposal shows there’s bipartisan energy for helping parents. (Delaney, 2/4/21)

CNBC: Mitt Romney proposes giving American families an extra $3,000 a year

Senator Mitt Romney (R-Utah) unveiled a plan on Thursday that would provide American families with a bigger financial boost than what’s proposed in the Biden administration’s $1.9 trillion relief package. But both plans fail to completely cover child-care costs for the average American. (Leonhardt, 2/4/21)

Also featured in The Hill (Jagoda, 2/4/21), Forbes (Jagoda, 2/4/21), POLITICO (Rainey, 2/4/21)

MSNBC: Romney jolts policy debate with plan for new benefit for children

Nearly a decade later, Romney remains a conservative Republican, but his willingness to extend “big gifts” to families has clearly evolved. (Benen, 2/5/21)

Opinion Pieces: The American Rescue Plan and Child Poverty

The New York Times: Helping Kids Is a Very Good Idea

Republicans won’t support the Democrats’ proposal, but they should. (Krugman, 1/25/21)

The Hill: Biden and Congress can change child poverty with the stroke of a pen

The importance of the 2020 election will be felt for generations — not only for the end it brings to four years of tumult and division, but for the policy consequences. (Moore, 1/28/21)

The Huffington Post: Congress Could Finally Make Life Better For Parents — If It Doesn’t Blow It

The pandemic has given lawmakers a chance to do what they should have done long ago to support families. (Multiple Authors, 2/2/21)

The Hill: The care economy as an infrastructure investment

Infrastructure investment is at the top of the agenda for the new administration and for members of Congress on both sides of the aisle, as it’s a tried-and-true strategy for creating jobs while fulfilling a public need in the midst of a deep recession. (McCulloch & Poo, 2/2/21)

Forbes: How Biden Could Expand And Better Target The Child Tax Credit

In a recent blog, there were two ways discussing how Congress could refocus those $1,400 per person relief payments on those who need it most. But there is an even stronger case for better targeting President Biden’s proposed increases in the Child Tax Credit (CTC). (Gleckman, 2/2/21)

The New York Times Magazine: We Are a Nation of Child Abusers

But Biden has offered a way to reduce child poverty by half. That would be transformative. (Kristof, 2/3/21)

The Washington Post: Opinion: Does bipartisanship matter more than helping kids?

Argue all you want about spending and deficits and big government, but please don’t pretend that what Biden has proposed is some sort of left-wing craziness. (Dionne Jr., 2/3/21)

FDR showed us how to make sure that older Americans live decently at the end of their lives; it is at least as important to make sure that those who will carry on after them are taken care of as well. (Tumulty, 2/8/21

The New York Times: The Plot to Help America’s Children

And what we can learn from right-wing opposition. (Krugman, 2/15/21)

The 74: Biden’s Proposed Child Tax Credit Is Smart Fiscal Policy, But That’s Not the Real Reason America Should Take Better Care of its Children

As more details of the Biden administration’s pandemic recovery plans came into focus last week, one element — aimed at reducing child poverty — stood out. (Williams, 2/16/21)

USA Today: Biden’s American Rescue Plan boosts working families with children, let’s make that permanent

Tucked into President Joe Biden’s $1.9 trillion American Rescue Plan are two provisions that, if made permanent, could bring more adults and parents into the workforce, cut the child poverty rate in half, and fulfill the promise that full-time work in America earns a good life. (McGrath, 3/5/21)

MSNBC: The stimulus bill’s Child Tax Credit expansion is exactly the pandemic relief parents need

The bill includes $125 billion in additional funding for the Child Tax Credit, which since 1997 has offered just what it says: a credit to give middle-class parents some tax relief. (Brown, 3/9/21)

The Washington Post: The stimulus shows U.S. attitudes about child poverty are changing in a big way

The United States will go from one of the stingiest wealthy nations when it comes to supporting the finances of families with children to one of the most generous. (Edelman & Dutta-Gupta, 3/15/21)

Fortune: The U.S. will spend billions in stimulus to tackle child poverty—still puny by global standards

Not only are a troubling number of American youths living below the poverty line, Washington and state capitals had been doing precious little to address it. At least, that was the case before President Joe Biden signed the American Recovery Plan (ARP). (Warner, 3/16/21)

The New York Times: A New Child Benefit Could Help Poor Women Stay Home. So What?

Commenters on the right and left are concerned that the child tax credit in the American Rescue Plan Act — up to $3,600 for children 5 and under, and up to $3,000 for kids 6 to 17 — will discourage women from working outside the home. (Bruenig, 3/19/21)

Early Learning Nation: OPINION: American Rescue Plan: the United States Finally Invests Serious Resources in Our Children

The United States has finally decided to invest serious resources in our children. It just took a pandemic for it to happen. (Covert, 3/19/21)

New America: The American Rescue Plan is a Big Freaking Deal for Families and Workers

According to advocates and researchers in work-family justice and gender equity spaces, the American Rescue Plan (ARP) is a BFD — a big freaking deal. (St. Julien, 3/19/21)

Morning Consult: If Not Now, When? It’s Time to Transform Child Care

President Joe Biden has signed the American Rescue Plan into law, granting $40 billion in child care funding and providing much-needed relief to providers, parents and children alike. (Cardona, 3/22/21)

Opinion Pieces: Romney’s Plan, and Comparisons with the American Rescue Plan

The Hill: Romney’s child benefit plan would support children during the coronavirus — and afterward

The push for monthly child benefit checks to American children just went bipartisan: Sen. Mitt Romney’s (R-Utah) newly proposed Family Security Act would give parents of children under 6 a $350 check each month, while parents of kids aged 6-17 would receive $250. (Eichner, 2/5/21)

The Washington Post: It’s encouraging that reducing child poverty is now a bipartisan aspiration

Bureaucratic issues would have to be convincingly resolved before the Romney plan, or anything like it, should become law, but it’s encouraging that cutting child poverty is a bipartisan aspiration. (Editorial Board, 2/5/21)

Forbes: Would Romney’s New Child Benefit Proposal Remedy Our Falling Birth Rate?

How does income affect fertility rates or, more generally, family size? Or, put more bluntly, do the poor have more kids than the middle class? Do they, are they’ve long been accused of, have “too many” kids?

(Bauer, 2/7/21)

The New York Times: Why the U.S. Needs the Romney Family Plan

America needs more babies. Public policy alone cannot deliver them, but it can help. (Douthat, 2/6/21)

Forbes: Romney, Biden and Booker Want To Fix Child Poverty. Which Plan Is Best?

As debate continues on the best methods for reinvigorating the post-pandemic economy, attention in Washington has suddenly turned to child poverty. (Rowan, 2/5/21)

The Washington Post: Three questions to ask about Biden’s and Romney’s child allowance proposals

After endorsements from President Biden and a high-profile Republican senator, the country seems on the verge of adopting a society-transforming idea: giving a “child allowance” to the poorest families. (Rampell, 2/8/21)

Quartz: Can Joe Biden and Mitt Romney revolutionize American child benefits?

The switch envisioned by Romney and Biden would move the US much closer to a universal child benefit—if lawmakers can close the gap between their two proposals. (Fernholz, 2/10/21)

CNBC: New child tax credit proposals could give families more money than the $1,400 stimulus checks

Part of Democrats’ $1.9 trillion coronavirus relief package, changes to the child tax credit, could actually give qualifying families more money than the direct payments. (Konish, 2/10/21)

Business Insider: Parents are set to be some of the biggest winners under the Biden administration. Here are 4 ways Democrats aim to support families.

Democrats are pushing forward with President Joe Biden’s fiscal stimulus proposal. Parents are set to be among the biggest beneficiaries. (Winck & Hoffower, 2/11/21)

The Hill: Romney’s plan to help families and promote work

High rates of child poverty are a national disgrace. Last year there were 10.5 million children living in poverty — more than one in seven kids. (Kearney and Schanzebach, 2/17/21)

The New York Times: The Romney Family Plan Sees the True Value of Parenting

There is dignity in work, but we should support more than just work done for wages. (Sargeant, 2/18/21)

The New York Times: The Biden and Romney Family Plans Go Too Far

A policy that sustains people in joblessness is not ultimately anti-poverty. (Cass, 3/2/21)

Overall Passage

First Five Years Fund: House Passes American Rescue Plan With $39 Billion in Child Care Relief

Early this morning, the House of Representatives voted to pass the American Rescue Plan, a sweeping pandemic relief package with $39 billion in child care relief funding, including $15 billion for the Child Care and Development Block Grant (CCDBG) program and $24 billion for a child care stabilization fund. (Uhnig, 2/27/21)

First Five Years Fund: Congress Passes American Rescue Plan with $39 Billion in Child Care Relief

The sweeping pandemic relief package includes $39 billion in child care relief funding: $15 billion in emergency funding for the Child Care and Development Block Grant (CCDBG) program and $24 billion for a child care stabilization fund. The bill will now go to President Biden to be signed into law. (Uhing, 3/10/21)